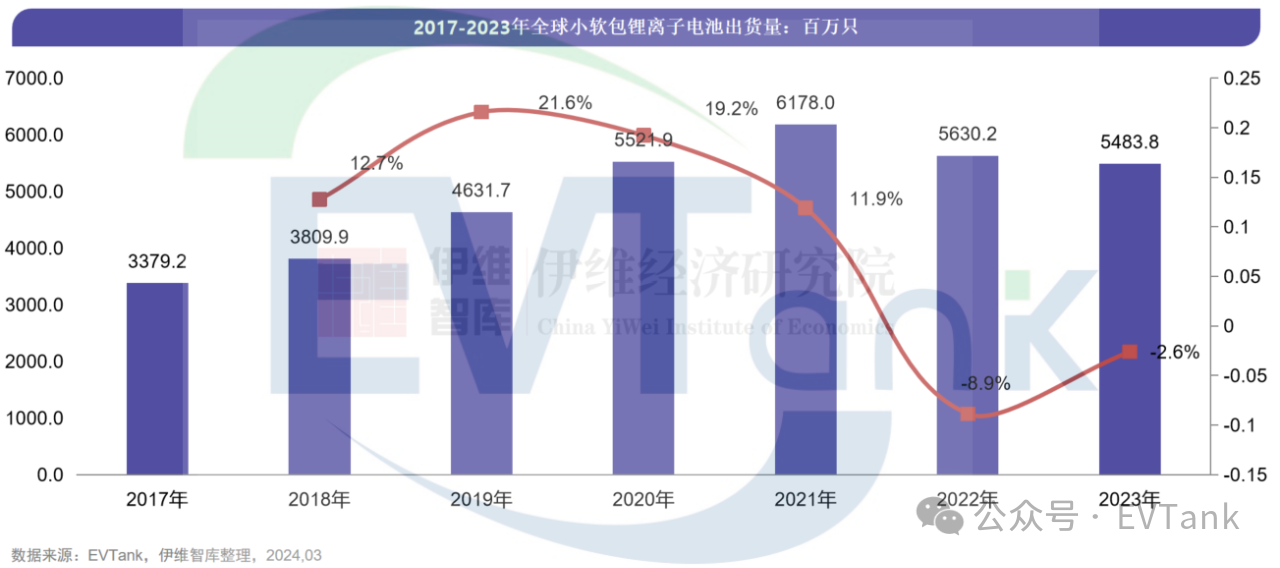

In 2023, the Global Shipment of 5.48 Billion Small Soft Pack Lithium Ion Batteries Declined Year-on-Year for Two Consecutive Years.

Recently, EVTank, a research institution, jointly released the white paper on the development of China's small Soft Pack lithium ion battery industry (2024). White paper data show that in 2023, 5.48 billion small Soft Pack lithium ion batteries were shipped worldwide, down 2.6 percent year-on-year, which has declined for two consecutive years. EVTank said that the world small Soft Pack Battery the decline in shipments and the fall in prices led to a 11.6 percent year-on-year decline in the market size of the entire industry in 2023. EVTank said in the white paper that smartphones and laptops are still the two largest application markets for small soft pack batteries, accounting for nearly 50%, in 2023, global shipments of smart phones and laptops declined by 4% and 14% year-on-year respectively. Other emerging consumer electronics fields include smart wearable devices such as AR/VR, unmanned aerial vehicles, smart homes, smart medical devices and other fields will be the new growth point of the small soft pack battery market in the future.

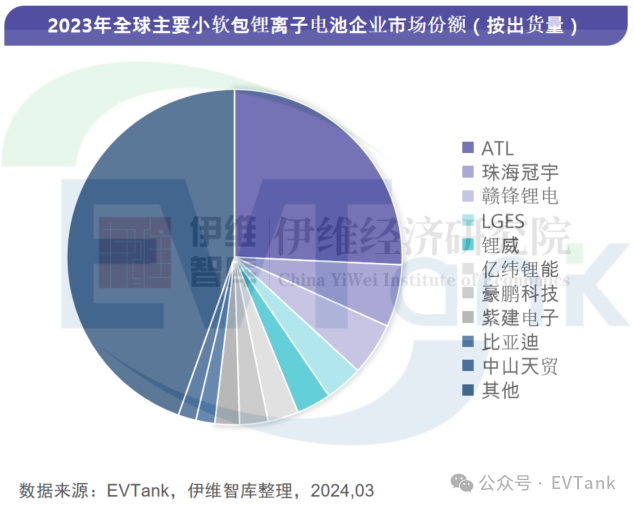

Judging from the competition pattern, the white paper on the development of China's small soft-Pack lithium-ion battery industry (2024) released by EVTank shows that the ETL owned by Japanese company TDK ranks first with more than 1.3 billion shipments, chinese company Zhuhai Guanyu ranks second in the world. Ganfeng electronics has rapidly improved its shipment ranking through a large number of shipments of TWS, electronic cigarettes and smart wearable batteries. The top ten companies in the world also include LGES, Liwei, yi Wei Li Neng, Hao Peng technology, Zijian electronics, BYD and Zhongshan Tianmao.

in the downstream market, EVTank said in the white paper that in the notebook computer field, enterprises need to focus on the update of Windows 11 and the new growth point of lithium batteries driven by AI PC, pay attention to the new growth point of lithium battery brought by folding screen mobile phones and super fast charge mobile phones in the field of mobile phones, and focus on AR/VR, smart home, the new demand for lithium batteries brought by intelligent medical devices and generated AI systems such as chatGPT. In terms of industry trends, EVTank suggested in the white paper to focus on the industry changes brought about by small soft pack lamination technology, the industrial application trend of solid-state batteries in consumer batteries, iPhone16 changes in the industry pattern brought by the use of metal shell batteries, etc.

In the white paper on the development of China's small Soft Pack lithium ion battery industry (2024), iwei Economic Research Institute analyzed the basic attributes and industrial chain of small Soft Pack lithium ion batteries, the overall shipments and market scale of small soft pack batteries, the competition pattern of different regions and different enterprises, including the basic situation of main application fields such as mobile phones, tablet computers, notebooks, wearable devices, unmanned aerial vehicles, electronic cigarettes, etc., and the key raw materials in the upstream aluminum plastic film, the benchmarking analysis of representative small soft pack battery enterprises has made in-depth research and analysis on the future market and technology development trend of soft pack battery industry. The global small soft-Pack lithium-ion battery enterprises involved in the white paper on the development of China's small soft-Pack lithium-ion battery industry (2024) include ETL, SDI, LGES, Zhuhai Guanyu, Murata, Tianjin Juyuan, Yiwei Lithium Energy, li Wei, BYD, Zhongshan Tianmao, Zijian electronics, Hengtai Technology, Vico technology, Ganfeng electronics, Hao Peng technology, Bick, Penghui and other enterprises.

Dongguan Juneng New Energy Technology Co., Ltd.

Dongguan Juneng New Energy Technology Co., Ltd.

137 5142 6524(Miss Gao)

137 5142 6524(Miss Gao)

susiegao@power-ing.com

susiegao@power-ing.com

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Yue Gong Wang An Bei No. 4419002007491

Yue Gong Wang An Bei No. 4419002007491