The Third Withdrawal of IPO Application of Super Shares in Lithium Battery Enterprises in Five Years

On July 20, Shenzhen Stock Exchange disclosed its decision to terminate the initial public offering of Luoyang Zhongchao New Materials Co., Ltd. (hereinafter referred to as "Zhongchao Shares") and its listing on GEM.

On June 6, 2023, Shenzhen Stock Exchange accepted the application documents of the first public offering of Super League shares and listing on the growth enterprise market in accordance with the law, and examined them in accordance with the regulations. A few days ago, Super League shares submitted to Shenzhen Stock Exchange the application of Luoyang Super League New Materials Co., Ltd. on withdrawing the application documents for initial public offering of shares and listing on the growth enterprise market. The sponsor submitted to Shenzhen Stock Exchange the application of Haitong Securities Co., Ltd. for canceling the initial public offering of stocks to Luoyang Zhongchao New Materials Co., Ltd. and listing on the gem. According to the relevant provisions of Article 62 of the review rules for stock issuance and listing of Shenzhen Stock Exchange (revised in 2024), Shenzhen Stock Exchange decided to terminate the review of the initial public offering of Super League shares and listing on the growth enterprise market.

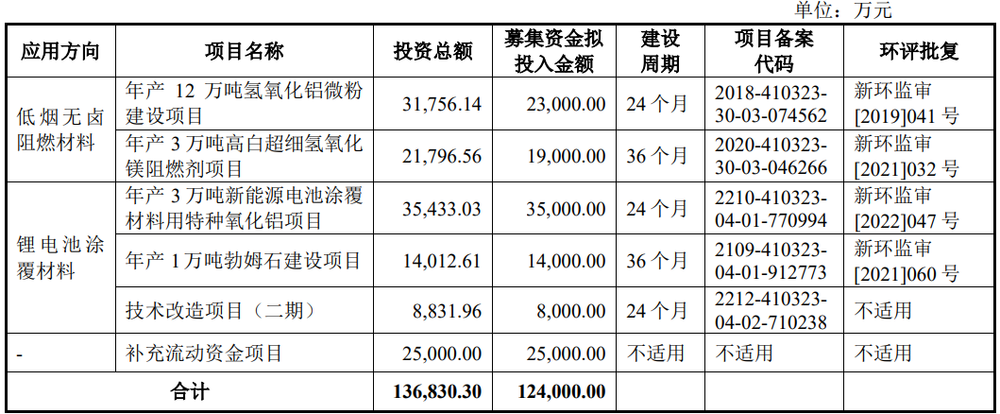

According to public information, China Super League is mainly engaged in research and development, production and sales of advanced inorganic non-metallic materials. Its main products include low smoke halogen-free flame retardant materials represented by ultra-fine aluminum hydroxide, and special aluminum oxide, coating materials for lithium batteries represented by boomite, etc. The IPO of Super League shares originally planned to raise 1.24 billion yuan. After deducting the issuance fee, it will be used for the construction project of 120000 tons of aluminum hydroxide micropowder with an annual output of 30000 tons of high white superfine magnesium hydroxide flame retardant project, special alumina project with an annual output of 30000 tons of coating materials for new energy batteries, 10000 tons of boomstone construction project, Technological Transformation Project (Phase II), and supplementary working capital project.

Among them, special alumina project for coating materials of 30000 tons of new energy batteries, 10000 tons of boomite construction project and technological transformation Project (Phase II) all belong to the category of lithium battery coating materials.

it is understood that this is the third time that the IPO has failed, and all of them have voluntarily withdrawn the materials. If the earlier counseling filing is included, the company has four IPO actions.

The Super League held IPO counseling and filing at the earliest in 2016, but it was terminated several months later; In June, 2019, the Super League declared the listing of the gem and was drawn to the site for inspection, and the company immediately voluntarily withdrew the listing materials; in October, 202020, the shares of China Super League started IPO again. This time it was replaced by the scientific innovation board, but the application was withdrawn the following year. In June, 2023, the company hit IPO for the third time. This time it was replaced by the growth enterprise market, and now it is withdrawn again.

Dongguan Juneng New Energy Technology Co., Ltd.

Dongguan Juneng New Energy Technology Co., Ltd.

137 5142 6524(Miss Gao)

137 5142 6524(Miss Gao)

susiegao@power-ing.com

susiegao@power-ing.com

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Yue Gong Wang An Bei No. 4419002007491

Yue Gong Wang An Bei No. 4419002007491