The Breakthrough of New Silicon Carbon Is Coming, Which Is Expected to Account for More than 75% by 2030.

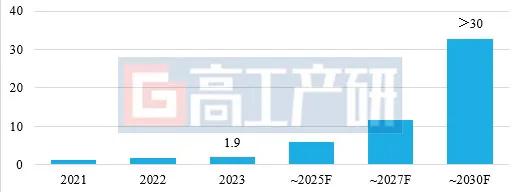

GGII data shows that in 2023, 19000 tons of silicon-based composite materials were shipped in China, and the shipment volume is expected to exceed 300000 tons in 2030, with an average annual compound growth rate exceeding 50%, in the next 3 to 5 years, the increase in shipping scale mainly depends on large cylindrical battery driven by solid-state batteries in the medium and long term.

The main application scenarios of silicon-based high-capacity batteries are: 1) electric tools and other small cylinders (such as high-end lithium light vehicles, high-end sweeping robots, etc.);2) Power lithium batteries, such as Zhiji cars, guangqi ai'an et al.; 3)3C digital lithium battery, such as Xiaomi mobile phone and glory mobile phone. 4) export to Japanese and Korean battery enterprises.

Shipments and forecast of lithium silicon-based composite materials in China from 2021 to 2030 (10,000 tons)

remarks: 1) statistical caliber is the amount after Composite; 2) at present, the industrialization of silicon composite materials generally adopts the form of composite with graphite materials; Data Source: Institute of High-tech production research lithium battery, in July 2023, the new silicon carbon material was ahead of the traditional silicon carbon and silicon oxygen materials in the first effect, capacity, circulation and expansion of the battery, and was the "disruptive technology product" of silicon-based negative electrode materials ". The new silicon-carbon anode industry is still in the early stage of industrial development, but the track has become crowded. According to the incomplete statistics of GII, more than 30 domestic enterprises have laid out new silicon-carbon anode technology (but no enterprise can achieve 100-ton capacity at present), and the breakthrough of engineering amplification and application after technological breakthrough is the key, in the next 3 to 5 years, we will strive to solve the problem of how to realize large-scale continuous production. GGII think there will be only 3 to 5 enterprises with more than 30 enterprises to break through and achieve success. The large-scale post-production cost of new silicon carbon is expected to be only higher than that of traditional silicon carbon and first-generation silicon oxygen. Therefore, GGI believes that the market share of new silicon carbon in 2030 is expected to exceed 75%, becoming the mainstream of the market. However, traditional silicon carbon and first-generation silicon oxygen occupy a certain cost-effective market by virtue of cost-effective advantages. However, at present, the new silicon carbon still has high cost, low yield (only 50 ~ 60%), and cannot be mass produced on a large scale (the industry is still doing 20kg equipment, to 100 tons of equipment supporting industrial chain faults) and product consistency difficult to control (affected by porosity, multi-batch production, etc.) problems need to be solved urgently.

Comparative analysis of performance parameters of silicon-based technology route

note: 1) it is the composite performance; 2) pole piece expansion data is tested by the battery factory, and the composite product data source is 450mAh/g: high-tech production research lithium battery Research Institute (GGII), in July 2023, semi-solid lithium battery in order to achieve lower cost and rapid industrialization, its mainstream material system is basically the same as that of liquid lithium battery. However, due to the main high-performance market, high-performance negative electrode materials are mainly used, for example, artificial graphite with high capacity, high magnification and long cycle or silicon-based anode materials with higher capacity will benefit the industrial development of semi-solid lithium batteries.

In order to better study the market development status of silicon-based anode materials in China, the Institute of High-tech production research lithium battery (GII) has investigated major domestic anode material manufacturers, silicon-based anode manufacturers and battery enterprises, after collecting a large amount of first-hand data, complete the preparation of this report. This report makes a detailed study and analysis on the downstream demand, market characteristics, Main Products, enterprise shipments, development planning and key enterprises of China's lithium silicon-based anode industry.

Dongguan Juneng New Energy Technology Co., Ltd.

Dongguan Juneng New Energy Technology Co., Ltd.

137 5142 6524(Miss Gao)

137 5142 6524(Miss Gao)

susiegao@power-ing.com

susiegao@power-ing.com

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Yue Gong Wang An Bei No. 4419002007491

Yue Gong Wang An Bei No. 4419002007491