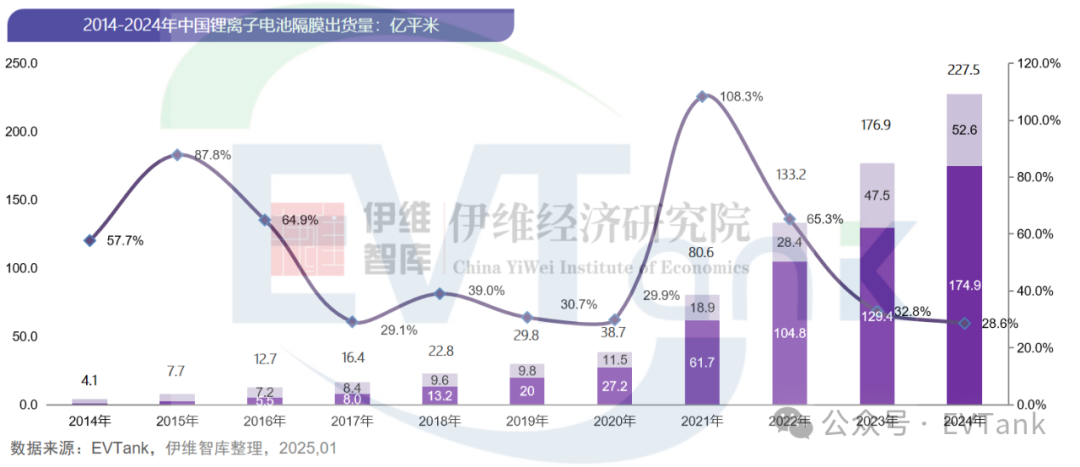

In 2024, China Shipped 22.75 Billion Square Meters of Lithium-Ion Battery Separators, and the Two Companies Rushed into the Top 10 for the First Time.

Recently, the research institution EVTank and the Yiwei economic research institute jointly released China lithium ion battery white paper on the development of diaphragm industry (2025). According to White paper data, in 2024, China's shipments of lithium ion battery separators increased by year-on-year, reaching 22.75 billion square meters, of which wet diaphragm shipments reached 17.49 billion square meters and dry diaphragm shipments reached 5.26 billion square meters.

From the perspective of different types of diaphragm shipments, EVTank statistics show that in 2024, wet diaphragm shipments increased by 35.2% year on year, and its proportion in the entire diaphragm shipments increased to 76.9% again, compared with 73.1% in 2023, it increased by 3.8 percent age points, and the shipment proportion of dry diaphragm declined to 23.1.

EVTank separately studied the market share of wet diaphragm enterprises and dry diaphragm enterprises in the white paper on the development of China's lithium ion battery diaphragm industry (2025). Among the wet diaphragm enterprises, the enterprises with the highest shipment volume in 2024 were Shanghai engjie, Hebei Jinli, Xingyuan material, Sinoma technology, Jiangsu Housheng, Leke Tu, Pu Tailai Zhuoqin, Beixing new material and Cangzhou Pearl. Among the dry diaphragm enterprises, the enterprises with the highest shipment volume in 2024 were Xingyuan material, Huiqiang new material, ZTE new material, Bosheng new material, etc. In addition, the diaphragm shipments of enterprises including Kang Hui's new materials and Changyang technology all increased greatly in 2024. The competition in the whole lithium battery diaphragm industry is still very fierce, and the overall capacity is still in an excess state.

Dongguan Juneng New Energy Technology Co., Ltd.

Dongguan Juneng New Energy Technology Co., Ltd.

137 5142 6524(Miss Gao)

137 5142 6524(Miss Gao)

susiegao@power-ing.com

susiegao@power-ing.com

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Xinghuiyuan High tech Industrial Park, Dalang Town, Dongguan City, Guangdong Province

Yue Gong Wang An Bei No. 4419002007491

Yue Gong Wang An Bei No. 4419002007491